If a large portion of receivables remains uncollected for extended periods, it may indicate problems with tenant creditworthiness or inefficiencies in the collection process. This situation can lead to an increase in the allowance for doubtful accounts, which is recorded as an expense on the income statement. An elevated expense for doubtful accounts reduces net income, potentially affecting profitability metrics and investor perceptions. For lessors, the process begins with classifying the lease as either an operating lease or a finance lease. In an operating lease, rent receivable is typically recorded as income over the lease term, reflecting the periodic payments made by the lessee.

- However, ASC 842 aims to increase transparency for stakeholders by including a lease liability and corresponding ROU asset on the balance sheet for operating leases.

- Automated reminders through property management software like Buildium or Rentec Direct can prompt tenants to pay on time, reducing the incidence of late payments.

- Our mission is to provide entrepreneurs and small business owners with the knowledge and resources they need.

Is rent payable a debit or credit?

Regular monitoring and analysis of these ratios can provide valuable insights, enabling property managers to make informed decisions and implement corrective measures when necessary. Once impairment is identified, the next step is to measure the extent of the impairment loss. This involves estimating the future cash flows expected from the impaired receivable and discounting them to their present value. The difference between the carrying amount of the receivable and its present value represents the impairment loss, which must be recognized in the financial statements. This process ensures that the financial records accurately reflect the diminished value of the receivable. The rent receivable account is used to record the amount of rent that has been earned but is yet to be collected.

Key Concepts and Accounting for Rent Receivables

However, with the introduction of ASC 842, lease accounting has become more complex, and with it, the recognition of rent expense. Organizations must now recognize both an asset and a liability for their operating leases. Specifically, they record a lease liability equal to the present value of future lease payments and a right-of-use asset that corresponds to this liability, with adjustments for certain amounts. Effective cash flow management hinges on the timely collection of rent receivables. Delays in rent payments can lead to cash flow shortfalls, making it difficult to cover operational costs such as maintenance, utilities, and staff salaries. To mitigate this risk, many property managers implement proactive collection strategies.

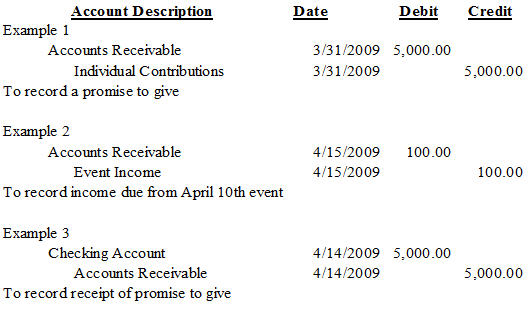

Accounting for accrued rent with journal entries

Advanced accounting systems like SAP and Oracle Financials can aid in generating these disclosures, ensuring compliance with regulatory requirements. Rent receivable is a critical aspect of financial accounting, particularly for businesses and individuals involved in property leasing. It represents the amount owed by tenants to landlords or lessors for the use of rental properties. Properly accounting for rent receivable ensures accurate financial reporting and compliance with relevant accounting standards. Rent receivable is a balance sheet asset account that indicates rent earned but not collected as of the balance sheet date.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Per his research, he learned about the Ms. Buddy Bear Commercial property. However, the agreement happened after the close of the current financial year. Step 2 – Transferring rent receivable journal entry receipt of rental income to the income statement (profit and loss account). Another important aspect of measurement is the consideration of variable rent components.

This lag can create a disconnect between reported earnings and available cash, posing challenges for managing day-to-day expenses and obligations. Proper accounting of rent receivables helps to accurately track rental income for the landlord and provides an accurate picture of the landlord’s financial position. Rent Receivable should be monitored regularly and reconciled with rent payments to ensure accuracy and to prevent any discrepancies. When the company receives the rent payment, it can make the journal entry by debiting the cash account and crediting the rent receivable account. An important account you must maintain is a rent receivable or accrued rent account. Both accounts are identical and report the same balances; the only difference is the name.

Aging reports categorize receivables based on how long they have been outstanding, which is instrumental in identifying potential collection issues early. Any Leased shop requires a non-refundable security deposit of $100,000 with a minimum lease term of 2 years. An advance amount of $30,000 is to be paid just after entering into the Lease agreement. This advance will be adjusted against the Lease rent payable towards the end of the Lease term. Income and expense a/c is credited to record the journal entry of rent received. The Rent Receivable account should be reconciled with the tenant’s rent payment to ensure accuracy.

Deferred rent is a liability resulting from the difference between actual cash paid and the straight-line expense recorded on the lessee’s financial statements for an operating lease. Under ASC 840, total rent expense is required to be recognized on a straight-line basis over the lease term even if rent payments vary. Deferred rent arose when lease payments were not the same amount over the lease term, for example, when a lessee has escalating payments or free rent. Deferred rent is a liability created when the cash payments and straight-line rent expense for an operating lease under ASC 840 do not equal one another. The transition to ASC 842 eliminated the deferred rent account from the balance sheet, but ultimately did not impact net income. Under ASC 842 any differences between the expense recognized and the actual cash paid are recognized in the lease liability and ROU asset.