The format of a double-column cash book given above has six columns on both debit and credit sides. The purpose of cash and bank columns has already been explained at the start of this article. The purpose of the date, description, voucher number (VN), and posting reference (PR) columns has been explained in the single-column cash book article.

Double Entry Bookkeeping

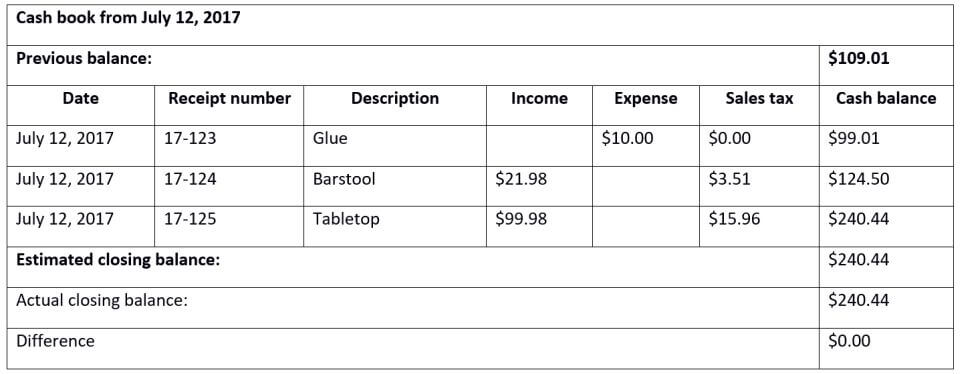

This includes enhancements like the addition of receipt number textboxes, making the app increasingly user-friendly and adaptive to specific user needs. Furthermore, CashBook’s responsiveness to issues, such as app functionality post-update, demonstrates a commitment to reliability and free invoice templates user satisfaction. You can read the previous four chapters of our accounting learning course here if you missed them. By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on.

#3: Three Column Cash Book

- The source of bank statement entries is cheques deposited by customers, payments made to suppliers by issuing a draft or check.

- The single column referred to in the name of this cash ledger book is the monetary amount of the cash receipt (Cash) highlighted in gray.

- The cash flows will change with every transaction that is recorded in the petty cash book.

- This is the reason why it is called a single column cash book (or a simple cash book).

- Despite being difficult to maintain on a large scale, organizations ensure maintaining cash book accounting for a handful of reasons.

A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited. If the debit column is larger than the credit column, the difference represents cash at bank. If, on the other hand, the credit column exceeds the debit column, the difference represents «overdrawn balance». It is worth mentioning that the format of a three column cash book is similar to that of a two column cash book. Despite being difficult to maintain on a large scale, organizations ensure maintaining cash book accounting for a handful of reasons. Irrespective of the number of sub-divisions, each page of the cash book can have a number of formats from single column to multi-column.

What is an analytical petty cash book?

When recording transactions in a cash book, many things need to be considered. For example, if money has been received, the description might be “Received in cash from client for a service.” The amount is the amount of the transaction. A contra entry is when an entry is made on the debit side and the same entry is recorded on the credit side of the cash book. To differentiate contra entries from other entries, letter «C» is printed in the posting reference column (on both the debit and credit sides of the cash book).

Receipt of Cheque or Cash

Discount allowed is an expense, and discount received is an income of the business. If you are a business and you want to start using a bank cash book, you will need to speak with your bank. They will be able to provide you with the necessary forms and help you get started. There are a few different types of cash books which all work slightly differently.

Do you already work with a financial advisor?

The single-column cash book (also known as simple cash book) is a cash book that is used to record only cash transactions of a business. The following Cash Book examples outline the most common Cash Books. Cashbook is a financial journal that contains all the cash receipts and cash payments, including the deposit in the bank and withdrawals from the bank. All the cash receipts are recorded on the left side of the cash book entries, whereas all the payments in cash are recorded on the right side. The difference between the sum of balances on the right and left sides shows the cash on hand.

Second, the items on the debit side of the cash book are posted to the credit sides of the accounts in the ledger, and the respective account numbers are entered in the posting reference column of the cash book. Bank charges are recorded on the credit side of the cash book in the bank column. This is because cash at bank decreases as a result of such charges. If a payment is made by cheque, it will be recorded on the credit side in the bank column.

This type of cash book is used by businesses who want to track each individual transaction in more detail. Double column cash books will show things like bank transaction details. Contra entries are not posted because the double entry accounting for these transactions is completed within the cash book. All items on the debit side of the cash book are posted to the credit of respective accounts in the ledger. All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger. Firms record all their cash and bank transactions in a cash book for easy tracking and law compliance.